Across the world, the sharpest minds, most experienced think tanks, and smartest algorithms dedicate their existence to accurately predicting supply and demand. But with COVID-19, the economy is anyone’s guess.

The global pandemic declared in March 2020 upended business and altered the way society consumed goods and traded services, sending even historically stable industries like waste & recycling management into turmoil—and the crisis is still peaking.

Plagued by unprecedented labor shortages and supply chain disruptions that threaten delays and discontinued recycling service, haulers and customers alike are scrambling for solutions. Meanwhile, an unexpected silver lining has emerged for companies seeking sustainability: the recycling sector hasn’t been this profitable in years.

So, the million-dollar question: How does the waste industry respond?

Waste Collection Delays Are a Staffing Issue

Missed pickups... Mountains of garbage... And yet idle compactor trucks and processing downtime. It’s a bizarre recipe that only a business-altering global event could cook up.

This predicament isn’t limited to one stretch of the country, nor one single calendar year: Philadelphia has been in a near continuous backlog since the pandemic began, prompting city officials to rent box trucks in the interim. Atlanta’s frustrations have grown so high that the city is offering $500 signing bonuses to anyone joining public works. After weeks of garbage backups in the Texas heat, the city of Dallas approved legislation to get things in motion. The list goes on… but how did we get here?

Primarily, the adverse and lasting effects on collection, especially for recycling, are caused by staffing shortages for licensed commercial drivers, truck mechanics, and workers at recycling processing centers called materials recovery facilities (MRFs).

Such labor issues are nuanced and multi-faceted, tied both to pre-pandemic trends and COVID-related developments. Starting pre-2020, the waste industry already faced a bit of a reckoning—qualified drivers, technicians, and other specialized employees were leaving their posts (quitting, retiring, etc.) and not being replaced.

The vacancies created a precarious situation that reached a tipping point in the early stages of the pandemic and has been exacerbated by its enduring uncertainty. According to Bloomberg, public sector and government jobs are still drastically below their pre-pandemic state, with 780,000 positions “missing.”

Part of this is the inability to entice new workers in a starkly different hiring environment. In a substantial May 2021 survey conducted by Prudential, 48% of Americans reported rethinking the type of job they want post-pandemic, 25% already plan to change jobs, and 53% say they’d switch to an entirely new industry provided they can retrain.

Evidently, the pandemic has shifted the priorities of the majority of the workforce to stress competitive compensation, work-life balance, and growth opportunities.

With mountains of waste to dig out from, health & safety concerns still present, and a skeleton staff worn even thinner by the past pandemic months, one could see how work in the industry might be a difficult job pitch.

In addition to the rigors and physical demand of waste collection, the machinery of industry creates a barrier to entry. From learning to pilot bulky compactor trucks to safely manning conveyor belts that send materials whizzing past at 20 miles per hour, there’s a learning curve many workers are choosing to avoid entirely.

For the latter role, it gets more complicated by our current reality. MRFs gather hundreds of workers in close proximity to manually sort what the machine cannot, which has led to numerous facility shutdowns for COVID-19 outbreaks. Operationally, the skilled technicians that the industry has retained to fix its big machinery have faced difficulty in receiving the parts they require because of pandemic-related supply chain disruptions.

Experts now suggest summer 2021 could be the crisis’s crescendo. The hotter months already bring expected difficulties and delays that make something thought of as routine much more volatile. Escalating matters, the labor squeeze adds a layer of complexity since the pandemic has been yo-yoing waste volumes between residential and commercial sectors.

Viewing through the commercial lens, we’re acutely aware of its effect. RoadRunner Recycling partners with businesses large and small across industries from manufacturing to hospitality to commercial and residential real estate. But, we don’t haul trash.

Instead, we leverage our relationships with local vendors and tech-driven logistical expertise to optimize everything from the pickup to how it’s reflected on your company’s waste bill. However, because RoadRunner works alongside other haulers, a labor shortage still affects service.

Thus, our advice in the matter is to anticipate fluctuations in your company’s waste volumes as far in advance as possible, notifying your MSW hauler with the largest amount of lead time. If your hauler has temporarily suspended recycling service (which many have to prioritize municipal solid waste), you can seek out local collection or drop-off sites for such materials, as the added tonnage to your waste stream might greatly increase your bill.

The irony of the situation is that a labor shortage creates twice as much work for not only the waste industry but its customers, too. Yet, while there is no pandemic playbook, hauling your own recycling is not the only move.

New Perspectives for Waste Management Slowdowns

RoadRunner Recycling’s unique position in the market allows for more perspective to the crisis. While collecting mountains of overdue garbage will take priority for most of the industry for months to come, it doesn’t have to be an all-or-nothing situation.

RoadRunner’s pioneering recycling service, FleetHaul, has established continuity and resiliency through community-building. Our fleet is entirely third-party, meaning we empower independent owner-operators of approved collection vehicles (box trucks, cargo vans, flatbeds, dump trucks, etc.) and commercial truckers to build a lucrative and flexible business for themselves.

Directed by our proprietary logistics engine, our team operates ultra-efficiently, effectively reducing our carbon footprint and proudly proving essential throughout the pandemic lockdowns.

[Drive with Us: We’re Looking for FleetHaulers in 20 Major Markets]

Following our “clean-stream” recycling method, materials like cardboard, paper, aluminum, glass, and plastic often skip MRFs entirely, with FleetHaulers delivering directly to end-market buyers.

Demonstrating its worth, supply changes caused by the pandemic have driven an insatiable demand for clean, on-time recyclable material. And that’s good news for all businesses.

Recycling Benefited from Supply & Demand Fluctuations

Remember the Great Toilet Paper Shortage of 2020? What if we told you the shelves stayed as bare as they did because we weren't running our office printers at nonstop pre-pandemic rates? That's right—TP makers didn't have enough recycled office paper and paperboard fiber to stem the spike in demand.

Something businesses often overlook is that, in the recycling industry, the value of recyclables isn't passed on in plastic jars, cardboard boxes, aluminum cans, and glass bottles. It's a commodities market that trades in pellets, pulp, ingots, and cullet—shredded, massed, and smashed-up raw materials ready for manufacturers to form new products from.

[More from RoadRunner’s Waste Watchers blog: Why Are Aluminum Cans So Valuable?]

If recycled properly—with as little contamination as possible—there's almost always a market for clean material. That's especially true today.

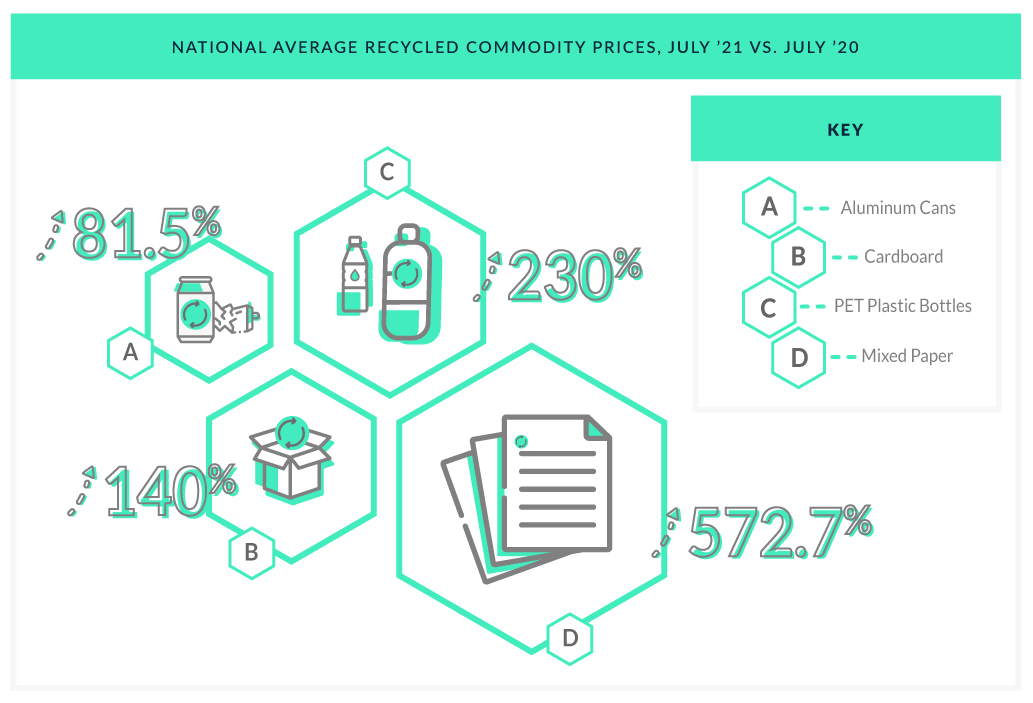

As the COVID-19 pandemic crippled supply lines and slowed production, demand for paper, cardboard, glass, and aluminum has greatly outstripped supply. The biggest surprise: The commodity price for post-consumer plastics (PET, HDPE, and PP included) has surged, too.

Stoked by recycled content percentage minimums for production and lofty corporate sustainability goals, plastic recycling has become profitable (and desirable) for municipalities and businesses for the first time in a long time.

July 2021 market pricing for post-consumer plastic is up 230.3% from the previous year nationally (and as high as 1,600% in some regions), reflecting manufacturer demand for #1 and #2 plastics commonly found in plastic bottles and home goods.

Bringing this full circle, the expected laws of supply and demand define why discontinued recycling service is bad for business. With even more scarcity of post-consumer materials, commodity prices soar, the cost of goods sold goes skyward, and margins vanish.

By recycling more with RoadRunner’s FleetHaul service, producers get more sustainable commodities, consumers get cheaper goods, traditional waste haulers can catch their breath, and the environment doesn’t bear the burden of thousands of tons of wasted opportunity.

To discuss a situation where everyone wins, our version of a pandemic playbook, get in touch with a RoadRunner strategy specialist today.